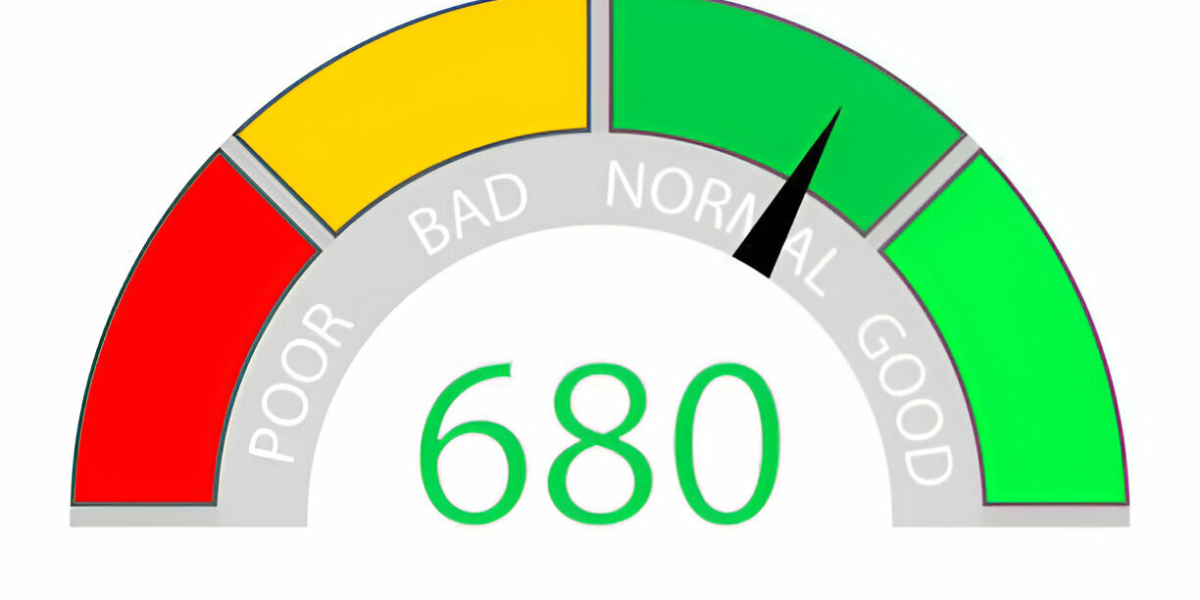

In a world where financial decisions carry more weight than ever, your credit score can determine the quality of opportunities available to you. From renting an apartment to securing a business loan, your credit report plays a central role. Unfortunately, many people deal with low scores caused by mistakes, outdated information, or past financial struggles. This is why credit repair has become an essential service for anyone seeking to rebuild their financial foundation.

Credit repair focuses on identifying errors, challenging inaccuracies, and educating consumers on proper credit behavior. As the demand for these services increases, so does the opportunity for marketers and financial educators to participate in the growing industry—especially through models like the credit repair affiliate program.

The Real Value of Credit Repair

Most people don’t realize how many mistakes can appear on their credit report. A single incorrect entry—a wrong balance, an outdated late payment, or a fraudulent account—can significantly damage a credit score. These errors often go unnoticed until the consumer applies for credit and faces unexpected denial or high interest rates.

Credit repair helps address these issues by:

-

Reviewing reports from all three major bureaus

-

Identifying questionable or inaccurate items

-

Filing disputes to correct or remove errors

-

Guiding consumers toward better financial habits

-

Providing long-term credit improvement strategies

When these mistakes are resolved, consumers can experience meaningful score increases that lead to better financial opportunities.

Why Credit Repair Demand Is Growing

As economic conditions shift, more people are paying close attention to their credit profiles. Rising loan costs, stricter approval requirements, and higher interest rates have pushed consumers to prioritize improving their credit health. A better score can make a major difference in both short-term decisions—like getting approved for a car loan—and long-term planning, such as buying a home.

Alongside this rising demand is a growing interest in credit-related content online. Bloggers, influencers, and financial coaches have found new opportunities by joining a credit repair affiliate program, which rewards them for connecting consumers with reputable credit repair companies.

How a Credit Repair Affiliate Program Works

A credit repair affiliate program allows individuals to earn commissions by referring clients to a credit repair service. Affiliates receive a special tracking link and promote the service through educational content, blog posts, videos, or social media.

What makes these programs appealing is their simplicity and earning potential:

-

Free to join

-

High consumer demand

-

Consistent search interest

-

Strong conversion rates

-

Access to professional marketing tools

For creators in the finance space, this offers a meaningful income opportunity while also helping people improve their financial well-being.

The Impact of Credit Repair on Financial Confidence

Credit repair empowers consumers to take control of their financial future. When someone understands their credit and takes steps to improve it, they gain confidence, clarity, and peace of mind. Better credit leads to lower interest rates, easier approvals, and greater flexibility—benefits that can significantly improve quality of life.

At the same time, affiliates who provide honest guidance help people access trusted services while earning income, creating an ecosystem where everyone benefits.

Final Thoughts

Credit repair is more than just correcting a score—it’s about rebuilding financial stability and opening new possibilities. With the industry continuing to expand, marketers and educators have an excellent opportunity to participate through a credit repair affiliate program. The niche remains powerful, profitable, and impactful for consumers and affiliates alike.